National Income (NI) is a fundamental concept in economics, acting as a key metric for gauging a country’s economic performance. As an important economic metric of a nation, it influences policy decisions, investment considerations, and socio-economic planning. This article of NEXT IAS aims to study in detail the concept of National Income (NI), its measures including Gross Domestic Product (GDP) and Gross National Product (GNP), methods employed to compute it, and other related concepts.

What is National Income (NI)?

It refers to the aggregate value of all the final goods and services produced in a country in a particular period of time (usually one financial year).

What is National Income Accounting?

It is a bookkeeping system that a national government uses to measure the level of the country’s economic activity in a given time period.

Basic Concepts Related to National Income Accounting

Understanding the concepts of National Income (NI) and National Income Accounting requires understanding some related concepts. These concepts are dealt with in the sections that follow.

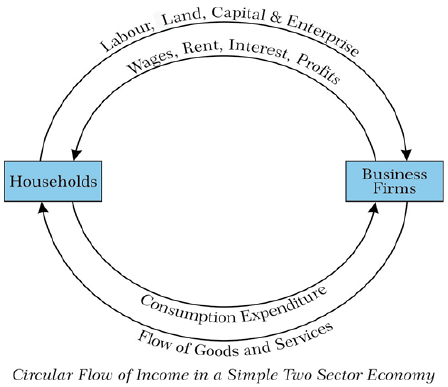

Circular Flow of Income

The circular flow of income is a model of the economy in which major exchanges are represented as flows of money, goods, services, etc. among the economic agents. As per this model, money and goods & services flow in the opposite direction but move in a closed circuit.

Production, consumption, and investment are important economic activities of an economy. In carrying out these economic activities, people make transactions between different sectors of the economy. Because of these transactions, income and expenditure move in a circular form. This is called the circular flow of income.

Domestic/ Economic Territory

It refers to the geographical territory administered by the Government of India within which the person, goods, and capital can circulate freely.

Note: Foreign embassies located in India are NOT a part of domestic/economic territory. However, Indian embassies located abroad are a part of domestic/economic territory.

Market Price (MP)

- Market Price (MP) refers to the price that a consumer pays for the product while purchasing it from the seller.

- In other words, it is the price at which a product is sold in the market.

- Market Price (MP) includes indirect taxes (as they are added to the selling price) and excludes subsidies received (as they are deducted from the selling price).

Factor Cost (FC)

- Factor Cost (FC) refers to the cost of factors of production that are incurred by a firm when producing goods and services.

- In other words, it is the cost of producing a good or service.

- Factor Cost (FC) excludes indirect taxes (since they are not related to the production process) but includes subsidies received (as these are direct inputs into the production).

Factor Cost (FC) = Market Price – Indirect Taxes + Subsidy

Nominal Price or Current Price

The market price of any good or service in the current year is called the Nominal Price or Current Price. Since inflation is included in the current market price, the Nominal Price or Current Price changes as per the current level of inflation.

Base Price or Constant Price

In order to compare the National Income of various years, it is calculated with reference to a particular year. This reference year is called the Base Year, and the market price of any good or service in the base year is called the Base Price or Constant Price.

Depreciation

Depreciation, also known as the Consumption of Fixed Capital, refers to the loss in value of fixed assets due to wear and tear, accidental damages, and obsolescence.

Net Factor Income from Abroad (NFIA)

Net Factor Income from Abroad (NFIA) is equal to the difference between factor income (rent, wages, interest, and profit) earned by normal residents of India temporarily residing abroad and factor income earned by non-residents temporarily residing in India.

NFIA = Factor Income from Abroad to India – Factor Income from India to Abroad

Transfer Payments

- Transfer Payments refer to those unilateral payments corresponding to which there is no exchange of goods or services.

- Examples: scholarships, gifts, donations, etc.

- Transfer payments are not included in National Income (NI).

Capital Output Ratio (COR)

Capital Output Ratio (COR) refers to the amount of capital (investment) needed to produce one unit of output.

Capital Output Ratio (COR) = Capital/Output

Capital Output Ratio (COR) reflects the level of efficiency in an economy. The higher the COR, the more capital is required to produce, and hence less efficiency is there in the economy, and vice versa.

Incremental Capital Output Ratio (ICOR)

Incremental Capital Output Ratio (ICOR) refers to the additional unit of capital (investment) needed to produce an additional unit of output.

Incremental Capital Output Ratio (ICOR) = Incremental Capital/Incremental Output.

Measures of National Income (NI)

There are various metrics for measuring the NI, such as:

- Gross Domestic Product (GDP)

- Gross National Product (GNP), etc

These measures are discussed in detail in the sections that follow.

Gross Domestic Product (GDP)

Gross Domestic Product (GDP) measures the aggregate production of final goods and services taking place within the domestic economy during a year.

Two key phrases here are:

- Final Goods and Services: It means that only the final, and not the intermediate, goods and services are taken into account for the calculation of GDP.

- Within the Domestic Economy: It means that the produce of resident citizens as well as foreign nationals who reside within that geographical boundary is considered.

GDP at Market Price (GDPMP)

GDP at Market Price (GDPMP) is the market value of all final goods and services produced within a domestic territory of a country during one financial year.

GDP at Market Price (GDPMP) includes indirect taxes but excludes subsidies.

GDP at Factor Cost (GDPFC)

GDP at Factor Cost (GDPFC) refers to the aggregate value of income earned from the factors of production i.e. Land, Labor, Capital, and Entrepreneurship.

GDP at Factor Cost (GDPFC) excludes indirect taxes but includes subsidies.

GDP at Factor Cost (GDPFC) = GDP at Market Price (GDPMP) – Indirect Taxes + Subsidies

Gross National Product (GNP)

Gross national product (GNP) is an estimate of the total value of all the final products and services produced in a given period by the production owned by a country’s citizens.

Two key phrases here are:

- Final Goods and Services: It means that only the final, and not the intermediate, goods and services are taken into account for the calculation of GNP.

- Owned by a Country’s Citizens: It means that the produce of resident as well as non-resident citizens of the country is considered, whereas that of the foreign nationals who reside within that geographical boundary of the country is NOT considered.

Thus, GNP = GDP + Factor Income from Abroad to India – Factor Income from India to Abroad.

= GDP + Net Factor Income from Abroad (NFIA)

Difference between GDP and GNP

The major difference between GDP and GNP lies in how the two concepts define the economy. While GDP defines the economy in terms of territory, GNP defines it in terms of citizens.

Thus, GDP measures the aggregate production of final goods and services taking place within the domestic economy. On the other hand, GNP measures the total value of all the final products and services produced by the citizens of a country.

Real GDP Vs Nominal GDP

Real GDP

Real GDP refers to the total value of all goods and services produced by an economy in a given year, expressed in constant prices or base year’s prices.

Thus, Real GDP = GDP at Constant Price.

Nominal GDP

Nominal GDP refers to the total value of all goods and services produced by an economy in a given year, expressed in current market prices.

Thus, Nominal GDP = GDP at Current Price.

It is to be noted that Nominal GDP includes inflation, while Real GDP does not.

GDP Deflator

The GDP Deflator refers to the ratio of Nominal GDP to Real GDP.

Thus, GDP Deflator = Nominal GDP/Real GDP

As a ratio of the NI calculated at the Current Price and that at a reference price, the GDP Deflator is an economic measure of inflation.

Gross Value Added (GVA)

Gross value added (GVA) is defined as the value of output less the value of intermediate consumption. It represents the contribution of labor and capital to the production process. Thus, the value of GVA can be derived from the GDP as follows:

GVA = GDP – Indirect Taxes + Subsidies

Difference between GVA and GDP

| GVA | GDP |

|---|---|

| Value of all the goods and services produced within a country after deducting the value of intermediate goods and services. | Market value of all the final goods and services produced within the country. |

| Gives insight into the economy from the input or supplier side. | Gives insight into the economy from the output or consumer side. |

| Generally, calculated on a sector-wise approach. e.g. GVA for the Primary Sector, Secondary Sector, etc. | Calculated for the whole economy. (GDP of economy = GVA of all the sectors) |

| Generally, calculated at Basic Prices. | Generally, calculated at Market Prices. |

Net National Income (NNI)

Net National Income (NNI) refers to Gross National Income minus the Depreciation of fixed capital assets. Thus, it takes into account the losses due to depreciation.

Prominent metrics for measuring the Net National Income (NNI) are:

- Net Domestic Product (NDP), and

- Net National Product (NNP)

Net Domestic Product (NDP)

Net Domestic Product (NDP) is arrived at by deducting the depreciation from GDP. Thus,

Net Domestic Product = GDP – Depreciation.

Net National Product (NNP)

Net National Product (NNP) is calculated by subtracting the depreciation from GNP. Thus,

Net National Product = GNP – Depreciation.

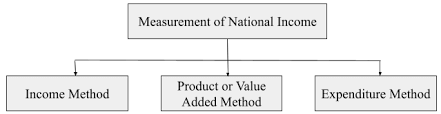

Methods of Computing National Income (NI)

National Income (GDP or GNP) can be calculated by 3 methods: Income Method, Expenditure Method, and Production Method.

Income Method

Under this method, NI is obtained by summing up the incomes of all individuals in an economy.

Individuals earn incomes by contributing their own services and the services of their property such as land and capital to the national production.

Thus,

National Income (NI) = Employee compensation + Corporate profits + Proprietors’ Income + Rental income + Net Interest

Product or Value Added Method

This is also called “Output Method”.

Under this method, NI is computed by adding the values of output produced or services rendered by the different sectors of the economy during the year.

It is to be noted that while computing the values of output figures, only the value added by each firm in the production process is taken into account. Thus, this method makes use of the concept of Value-added.

Expenditure Method

It is also called ‘Total Outlay Method’.

This method assumes that the income earned by an individual is either spent on consumer goods/services or saved and invested.

Thus,

National Income (NI) = Personal Consumption Expenditure (C) + Investments (I) + Government Expenditure (G) + Exports (X) – Imports (I)

New GDP Series

The Ministry of Statistics and Programme Implementation (MoSPI) launched a new series of GDP in 2019.

Major changes that have been made to the methodology of GDP calculation are as follows:

- Change in Base Year: The base year has been changed from 2004-05 to 2011-12.

- Factor Costs Replaced with Market Prices: The old series of GDP used Factor Costs for calculating GDP. The new series used market prices for calculating GDP.

- Widening of Data Pool: Previous data was sampled from the Annual Survey of Industries (ASI), which comprised about two lakh factories. The new database draws from the five lakh odd companies registered with the Ministry of Corporate Affairs (MCA21).

- While the earlier data gave only a factory-level picture, the new data looks at the enterprise level.

These changes have led to a significant change in the GDP figures. For example, India’s GDP growth rate for the financial year 2013-14 was 4.7% as per the old methodology, and 6.9% as per the new methodology.

Difficulties in Estimating NI

Major problems faced while estimating NI can be studied under two heads – Conceptual Difficulties and Statistical or Practical Difficulties.

Conceptual Difficulties

The conceptual problem relates to how and what is to be included and what is not in the measurement of National Income (NI). Though the concept of NI implies that everything that is produced should be reckoned, by definition, we consider only those things that are exchanged for money or carry some price.

In order to mitigate these difficulties, certain guidelines have been laid down about the process of National Income estimation, and about what components have to be included.

Statistical or Practical Difficulties

- The lack of adequate statistical data due to flaws in extrapolation, and ineffective training of illiterate statistical staff, makes the task of National Income estimation more acute and difficult.

- Multiple counting is also an important problem while calculating NI.

- India is a country with large regional diversities. Thus, different languages, customs, etc., also create a problem in computing the estimates.

Shortcomings of GDP

GDP, as an indicator of economic growth, faces some shortcomings as explained below:

- It fails to measure the inequality status of a nation. Thus, it does not describe whether or not the people are truly benefitting from economic growth.

- It does not take into account non-market transactions, such as volunteer work.

- Black markets and illegal activities create distortions in values and hence the figures of GDP.

- A large part of many undeveloped economies relies on barter trade (trade through swapping goods) rather than the employment of debt instruments and banknotes. GDP figures underestimate economic activities in such cases.

- GDP does not take into account the loss to the environment and hence undermines the concept of sustainable economic growth.

- GDP fails to measure the actual well-being of a nation as it counts “bads” as well as “goods.”

- When an earthquake hits and requires rebuilding, GDP increases. Similarly, when someone gets sick and money is spent on their care, it’s counted as part of GDP. But, we’re not better off because of a destructive earthquake or people getting sick.

- It does not measure the Happiness Level of a nation.

- For example, GDP makes no adjustment for leisure time.

Alternatives to GDP

Due to shortcomings of GDP to measure the welfare and well-being of the people, several other indicators have been proposed and are being used. Some of these indices are discussed below.

Genuine Progress Indicator (GPI)

- Genuine Progress Indicator (GPI) is a metric that has been suggested to replace, or supplement GDP as a measure of economic growth.

- It measures whether the environmental impact and social costs of economic production and consumption in a country are negative or positive factors in overall health and well-being.

Gross National Happiness (GNH)

- Gross National Happiness (GNH) attempts to measure the sum total not only of economic output but also of net environmental impacts, the spiritual and cultural growth of citizens, mental and physical health, and the strength of the corporate and political systems.

- The term was first coined by Jigme Singye Wangchuck, the King of Bhutan in the early 1970s.

Gross Sustainable Development Product (GSDP)

- Gross Sustainable Development Product (GSDP) measures the economic impacts of environmental and health degradation or improvement; resource depletion, depreciation; the impact of people’s activity on the environment; quality of environment, etc.

- It has been developed by the Global Community Assessment Centre and the Society for World Sustainable Development.

Human Development Index (HDI)

- Human Development Index (HDI) is a summary measure of average achievement in key dimensions of human development, viz:

- Health: Measured through – Life expectancy at birth

- Education: Measured through – Mean years of schooling, and Expected years of schooling

- Standard of Living: Measured through – Gross National Income per capita on a PPP basis.

- It was developed by Indian Economist Amartya Sen and Pakistani economist Mahbub ul Haq.

- It is published annually by the United Nations Development Programme (UNDP) as part of its Human Development Report.

Social Progress Index (SPI)

- The Social Progress Index (SPI) measures the extent to which countries provide for the social and environmental needs of their citizens.

- It focuses exclusively on indicators of social outcomes, rather than measuring inputs.

- It has been developed by the Social Progress Imperative.

Human Capital Index (HCI)

- The Human Capital Index seeks to measure the amount of human capital that a child can expect to attain by the age of 18.

- It measures three components:

- Survival: Measured by under-5 mortality rates.

- Expected Years of Quality-Adjusted School: Combines information on the following two aspects of education.

- Quality: Measured by harmonizing test scores from major international student achievement testing programs

- Quantity: Measured by the number of years of school that a child can expect to obtain by age 18 given the prevailing pattern of enrollment rates across grades in respective countries.

- Health: Measured using two indicators – adult survival rates, and rate of stunting for children under age 5 years.

Green GDP

Green GDP is a term used generally for expressing GDP after adjusting for environmental damages such as biodiversity loss, climate change impacts, etc. Thus, it is an indicator of economic growth with environmental factors taken into consideration.

In conclusion, much more than just a numerical figure, National Income (NI) is a comprehensive reflection of a country’s economic vitality. Though the current measures of NI have some shortcomings, they play a crucial role in guiding governments, businesses, and individuals in making informed economic decisions. As we strive for a more holistic understanding of progress, research & development should be carried out to develop more comprehensive measures of National Income (NI) that encompass social well-being and environmental sustainability.