Differentiated Banks in India, such as Payment Banks and Small Finance Banks (SFBs), have emerged as pivotal components in the evolving narrative of Indian finance. Envisaged to cater to specific segments of the economy, these banks play a crucial role in enhancing financial inclusion and providing tailored banking solutions to meet the diverse needs of a vast population. This article of NEXT IAS aims to study the concept of Differentiated Banks in India, their meaning, and major types such as Payment Banks, Small Finance Banks, and Local Area Banks.

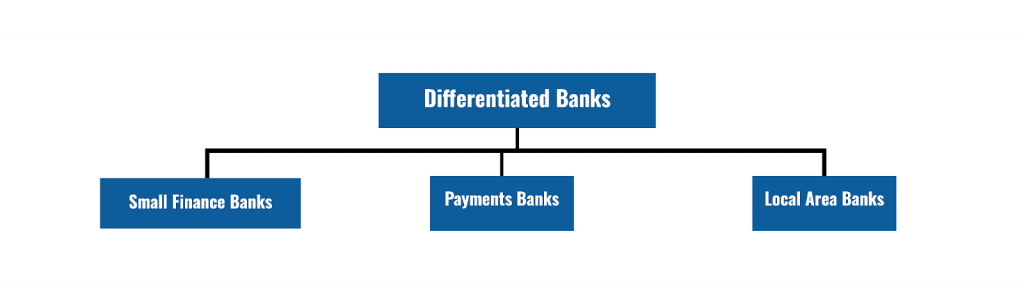

What are Differentiated Banks?

- Differentiated Banks under the Indian Banking System refer to those banks that cater to a specific segment of customers.

- The concept of Differentiated Banks was introduced in the Banking System in India by the RBI based on the recommendations of the Nachiket Mor Committee in 2013 in order to offer specialized services or unique products designed specifically to suit a particular sector.

Differentiated Banks Vs Universal Banks

Differentiated Banks differ from Universal Banks on account of capital requirement, the scope of activities, or the area of operations.

Unlike Universal Banks, Differentiated Banks are infused as Niche Banks that typically target a specific market and tailor the bank’s operations to the market preferences of their niche segment. Thus, as opposed to Universal Banks, Differentiated Banks do not offer all financial products. Rather, they offer a limited range of services and products, which are demanded by their niche segment.

Structure of Differentiated Banks in India

Based on their conception and objectives, Differentiated Banks in India can be categorized into the following types:

Small Finance Banks (SFBs)

- Small Finance Banks (SFBs) are a type of differentiated banks in India that provide a whole suite of basic banking products and services but in a limited area.

- In other words, these banks can do almost everything that a normal commercial bank can do but at a much smaller scale.

- They are registered as a public limited company under the Companies Act, 2013, licensed under the Banking Regulation Act, 1949, and regulated by the RBI Act, 1934.

- Examples of Small Finance Banks (SFBs) under the Banking System in India include – Capital Small Finance Bank, Ujjivan Small Finance Bank, etc.

Features of Small Finance Banks (SFBs)

- Can accept all types of deposits like commercial banks.

- Can give out depositors’ money as loans to other customers, but only in a small area of operation.

- Can also undertake non-risk sharing financial activities, such as distribution of mutual fund units, insurance products, pension products, etc.

- Their target customers are, usually, small business units, small and marginal farmers, micro and small industries, and other unorganized sector entities.

- Their focus is, mostly, on deposits and loans.

Objectives of Small Finance Banks (SFBs)

Some of the main objectives of Small Finance Banks (SFBs) can be seen as follows:

- Expanding Access to Financial Services: Their main purpose is to expand access to financial services in rural and semi-urban areas.

- Promoting Basic Banking Services: To offer basic banking services, such as accepting deposits and lending to underserved sections of customers.

- Alternative Option: To provide an alternative to some of the existing institutions, thus increasing financial inclusion and serving a variety of unserved clients.

Major Guidelines for Small Finance Banks (SFBs)

- Eligible promoters of SFBs could be resident individuals/professionals with 10 years of banking experience, including companies controlled by them.

- Minimum paid-up equity capital shall be ₹100 crore from the date of commencement and has to be increased to a minimum of ₹ 200 crore in five years.

- All prudential norms and regulations of the RBI as applicable to existing Commercial Banks, including the requirement of maintenance of CRR and SLR, shall apply to SFBs.

- Required to maintain a minimum Capital Adequacy Ratio of 15% of its risk-weighted assets (RWA) on a continuous basis

- Should have 25% branches in rural areas.

- They shall primarily undertake basic banking activities of acceptance of deposits and lending to unserved and underserved sections.

- Their 75% of the loan is to be for Priority Sector Lending.

- 50% of the loans be given to the MSME sector.

- At least 50% of loans and advances should be upto ₹25 lakh.

Payment Banks

- Payment Banks are non-full service banks under the Indian Banking System that provide a limited range of products, such as acceptance of demand deposits and remittances of funds, but have a widespread network of access points particularly to remote areas, either through their own branch network, or through Banking Correspondents (BCs) or networks provided by others.

- The objective of setting up Payment Banks under the Banking System in India is to further financial inclusion by providing small savings accounts and payments/remittance services to migrant labor workforce, low-income households, small businesses, other unorganized sector entities, and other users.

- Examples of Payment Banks operating in the Banking System in India include – India Post Payments Bank (IPPB), Airtel Payments Bank, Patym Payment Banks, etc.

Features of Payment Banks

- Cannot give loans or lend to customers. They can invest depositor’s money in Government Securities (G-secs) only.

- However, they’re allowed to sell mutual funds, insurance, and pension products, accept utility bill payments, etc., to keep branch operations profitable.

- Can accept demand deposits.

- Can issue ATM/debit cards but not credit cards.

- Mainly deal in remittance services and accept deposits of up to ₹1 lakh.

- Cannot accept NRI deposits.

- Target customers, usually, include – Poor, migrants, and unorganized workers wanting to send remittances home.

Major Guidelines for Payment Banks

- Eligible promoters can be Non-Bank Prepaid Payment Instrument (PPI) issuers and other entities like mobile telephone companies, etc.

- The promoter’s minimum initial contribution to equity capital will have to be at least 40% for the first five years.

- Shall primarily accept demand deposits up to a maximum of ₹2,00,000 per individual customer.

- Have to comply with all regulatory and supervisory frameworks that are applicable to Commercial Banks.

- Have to maintain CRR with the RBI on its outside Demand and Time Liabilities and invest at least 75% of its Demand Deposit Balances in SLR-eligible G-Secs/Treasure Bills.

- Need to hold a maximum of 25% in current and time/fixed deposits with other scheduled commercial banks for operational purposes and liquidity management.

- Minimum Leverage ratio 3% i.e., liabilities should not exceed 33 times of its net worth.

Difference between Payment Banks and Small Finance Banks (SFBs)

| Criteria | Small Finance Banks | Payment Banks |

|---|---|---|

| Registration and Licensing | Registered under the Companies Act, and licensed under the Banking Regulation Act, 1949 | Registered under the Companies Act, 2013, and licensed under the Banking Regulation Act, 1949 |

| Eligibility | Resident Indians, Private Companies, Societies, NBFCs, MFIs, Local Area Banks | Pre-paid Payment Instrument (PPI) Providers, Resident individuals; NBFCs; Telecom Companies, super-market chains, public sector entities, etc. |

| Minimum Capital Requirements | ₹100 crores. (To be increased to ₹200 crores within 5 years) | ₹100 crores |

| FDI allowed | Yes. Up to 74% | Yes. Up to 74% |

| Accept Deposits | Yes. | Only Demand Deposits. No Fixed Deposits and NRI Deposits |

| Restrictions on Deposits | No Restrictions | Up to ₹1 Lakhs |

| Deposit Insurance Available? | Yes | Yes |

| Can Lend Loans | Yes. At least 50 percent of its loan portfolio should constitute loans and advances of up to ₹25 lakh. | No |

| Issue Debit/Credit Card | Can issue both Debit Cards as well as Credit Cards. | Only Debit Card. No Credit Card |

| Statutory liquidity ratio (SLR) and Cash Reserve ratio (CRR) applicable | CRR and SLR Applicable. | CRR Applicable; SLR: 75% of Net Demand and Time Liabilities (NDTL) |

| BASEL Norms applicable | Yes. 15% of Risk Weighted Assets (RWAs) | Yes. 15% of Risk Weighted Assets (RWAs) |

| Priority Sector Lending (PSL) Norms applicable | Yes. Target: 75%. | No. Can’t lend Loans |

Local Area Banks (LABs)

- Local Area Banks (LABs) are small private banks under the Banking System in India, which provide financial intermediation services in a limited area of operation, primarily in rural and semi-urban areas.

- The objective of setting up LABs was to enable the mobilization of rural savings and to make them available for investments in the local areas.

- Some examples of LABs operating in the Banking System in India include – Coastal Local Area Bank Limited, Capital Local Area Bank Limited, etc.

Major Guidelines for Local Area Banks (LABs)

- Should have a minimum capital of ₹5 Crores.

- Promoters of LAB may comprise private individuals, corporate entities, trusts, and societies with a minimum capital contribution of ₹2 Crores.

- Their area of operation is limited to a maximum of 3 geographically contiguous districts.

- They should have Priority Sector Lending targets at 40% of the Net Bank Credit (NBC).

| Note: In 2014, the RBI permitted LABs to convert themselves into Small Finance Banks (SFBs), subject to meeting prescribed eligibility criteria. |

Role of Differentiated Banks in India

- Financial Inclusion: By targeting specific customer bases and regions, these banks play a crucial role in bringing a large segment of the population into the formal banking system.

- Economic Growth: By providing credit facilities to MSEs, these banks fuel economic growth at the grassroots level, supporting employment and wealth creation in rural and semi-urban areas.

- Promoting Banking Habits: Increased access to deposits and basic financial products fosters a culture of saving and investment.

- Financial Innovation: These banks have introduced innovative banking and financial solutions tailored to the needs of their customers.

- For example, Payment Banks have leveraged mobile technology to facilitate easy and secure transactions, helping in the spread of digital banking across India.

- Healthy Competition: The presence of differentiated banks fosters competition in the banking sector, ultimately benefiting all customers with better rates and services.

Differentiated Banks in India represent a novel approach in the banking sector, designed to meet the specific needs of various customer segments. By focusing on inclusivity and specialized services, these banks not only contribute to the financial well-being of traditionally underserved communities but also encourage a more comprehensive economic development across the country. As they grow and mature, their innovative models will continue to influence the broader landscape of banking and finance in India.