The introduction of the Goods and Services Tax (GST) is one of the most significant reforms in the country’s indirect tax structure since independence. Along with unifying and simplifying the fragmented and complex tax system, it has helped enhance the Ease of Doing Business (EoDB) in the country. This article of NEXT IAS aims to study in detail the Goods and Services Tax (GST), its meaning, framework, features, benefits, and challenges. The article also deals with other related concepts such as GST Council, E-Way Bill, GST Network and more.

What is Goods and Services Tax (GST)?

- The Goods and Services Tax is a form of Indirect Tax levied on most of the goods and services sold in India for domestic consumption.

- It is based on the principle of Value Added Tax (VAT) and is applicable throughout India.

- It is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.

- It has subsumed and replaced various indirect taxes that were previously levied by the central and state governments.

History and Evolution of GST in India

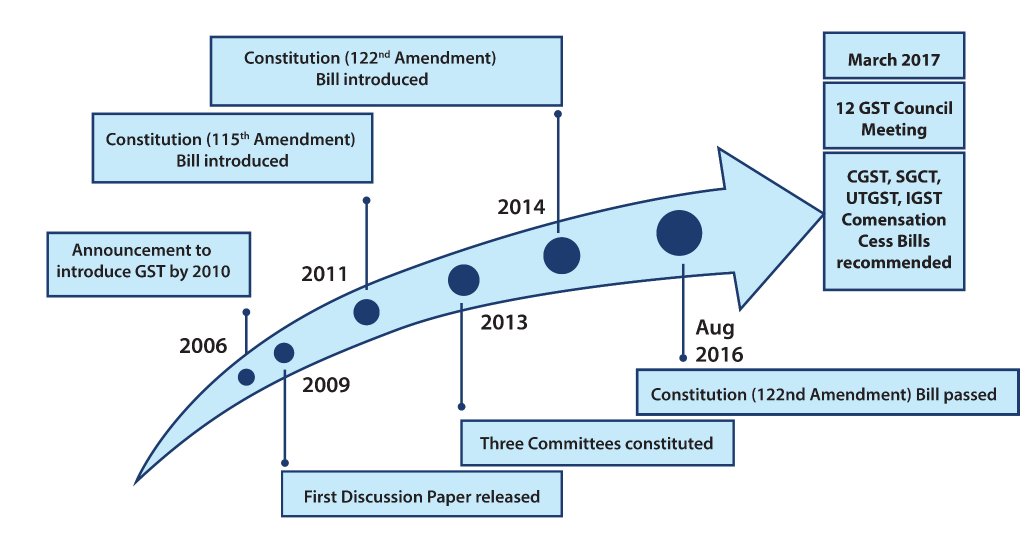

- In 2003, the Kelkar Task Force on Indirect Tax mentioned a comprehensive Goods and Services Tax, which is based on the principle of Value Added Tax (VAT).

- Budget Speech for the financial year 2006-07 made a proposal to introduce a National-level Goods and Services Tax by 1st April 2010.

- With an intention to do away with multiple indirect taxes and to have a ‘One Nation One Tax’ system, the Constitution (122nd Amendment) Bill was introduced in 2014.

- The Constitution (122nd Amendment) Bill was passed as the Constitution (101st Amendment) Act in 2016.

- Finally, the Goods and Services Tax was introduced and enforced across the country on 1st July 2017.

Constitutional Framework for Goods and Services Tax

- In order to provide for the constitutional basis for the introduction of the Goods and Services Tax, the Constitution (122nd Amendment) Bill was introduced in the Parliament in 2014.

- The same bill was passed as the Constitution (101st Amendment) Act in 2016.

- This amendment introduced 3 new articles in the Constitution:

- Article 246A – Both the Parliament and the State Legislatures will have concurrent powers to make laws related to GST. However, the Parliament will retain exclusive power to legislate in the case of inter-state trade of goods and services.

- Article 269A – In the case of inter-state trade where GST is levied and collected by the Union Government, the tax revenue proceeds to be apportioned by the Centre between the centre and states in a manner as may be provided by the Parliament by law on the recommendations of the Goods and Services Tax Council (GST Council).

- Article 279A – It empowers the President of India is empowered to constitute the GST Council and defines its composition and functioning.

Legal Framework for Goods and Services Tax

- After the passage of the Constitution (101st Amendment) Act, the following acts were passed by the Parliament to define the legal framework for Goods and Services Tax.

- Central Goods and Services Tax Act, 2017

- Integrated Goods and Services Tax Act, 2017

- Goods and Services Tax (Compensation to States) Act, 2017

- Union Territory Goods and Services Tax Act, 2017

- Also, each state passed their own State Goods and Services Tax Act.

- These acts, together, provide the legal framework for Goods and Services Tax.

Features of Goods and Services Tax

- Applicable on Supply: Under the GST regime, a taxable event is the ‘supply’ of Goods and Services, and not manufacturing, sales, etc.

- In other words, Goods and Services Tax is applicable to the ‘supply’ of goods or services. As opposed to the old indirect taxation regime, events like manufacturing, sales, etc do not matter now.

- Consumption-based Tax: It is based on the principle of destination-based consumption taxation as against the present principle of origin-based taxation.

- Therefore, it is paid to the state where the goods and services are finally consumed, and not the state in which they are produced.

- Dual Goods and Services Tax Model: India has adopted a Dual GST Model, with the Centre and the States simultaneously levying tax on a common tax base.

- Four Components: Under the Dual GST Model implemented in India, the GST has a total of 4 components – Central GST (CGST), State GST (SGST), Union Territories GST (UTGST), and Integrated GST (IGST).

- These four components have been explained in detail in the section below.

- Mutual Decision on Tax Rates: CGST, SGST, UTGST, and IGST are levied at rates to be mutually agreed upon by the Centre and the States.

- These rates are notified on the recommendation of the GST Council.

- Multiple Rates: Tax rates for different categories of goods and services are different. At present, there are a total of 7 tax-rate slabs for various goods and a total of 5 tax-rate slabs for various services.

- Exemptions: Businesses upto a certain level of turnover are exempted from GST. The turnover limit for exemption for various categories of businesses is as follows:

| Type of Business | Turnover Limit for Exemption from GST |

|---|---|

| Businesses dealing with only Goods. | ₹40 lakh (₹20 lakh for northeastern and hilly states) |

| Businesses dealing with Services or both Goods and Services. | ₹20 lakh (₹10 lakh for northeastern and hilly states) |

Components of GST

In total, the Goods and Services Tax comprises 4 components as explained below.

Central Goods and Services Tax (CGST)

- It is levied on the intra-state (within the same state) as well as intra-UT (within the same UT) supply of goods and services.

- It is levied and collected by the Central Government and its proceeds go to the Centre.

- It applies to every transaction within a state, alongside the State GST (SGST).

- For a particular good or service, it is levied at a uniform rate across the country.

- Example: If you buy a shirt from a store in your city, both CGST and SGST will be levied on the bill. Of these, the CGST component is levied by the Centre.

State Goods and Services Tax (SGST)

- It is levied on the intra-state (within the same state) supply of goods and services.

- It is levied and collected by the State Governments and its proceeds go to the concerned State.

- It applies alongside CGST on every intra-state transaction.

- For a particular good or service, its rate may vary from one state to another.

- Example: In the above example, the SGST rate would be specific to the state concerned.

Union Territories Goods and Services Tax (UTGST)

- It is equivalent to SGST for UTs that don’t have their own legislature.

- Thus, it is levied on the intra-UT (within the same UT) supply of goods and services.

- It is levied and collected by the UT Administration and its proceeds go to the concerned UT.

- It applies alongside CGST on every intra-UT transaction.

- For a particular good or service, its rate may vary from one UT to another.

- Example: In the above example, the UTGST rate would be specific to the UT concerned.

Integrated Goods and Services Tax (IGST)

- It is levied on the inter-state (between two different states) supply of goods and services.

- It is levied and collected by the Central Government, and its proceeds are distributed between the Centre and the states.

- In other words, it acts as a combined tax for both the Centre and States.

- For an inter-state or inter-UT transaction, IGST is levied instead of CGST and SGST/UTGST.

- For a particular good or service, it is levied at a uniform rate across the country.

- Example: If you order a book from an online retailer in another state, IGST will be levied instead of CGST, and SGST or UTGST.

| Type of GST | Applicable in | Collecting Authority | Benefiting Authority |

|---|---|---|---|

| Central GST (CGST) | Intra-State and Intra-UT transactions | Central Government | Centre |

| State GST (SGST) | Intra-State transactions | State Government | Concerned State |

| UT GST (UTGST) | Intra-UT transactions | UT Administration | Concerned UT |

| Integrated GST (IGST) | Inter-State and Inter-UT transactions | Central Government | Shared between the Centre and the States. |

Overall Composition of GST

The composition of the total GST paid by the consumer in various types of transactions is as explained below:

| Type of Transaction | Total GST |

|---|---|

| Intra-State Transaction | CGST+SGST |

| Intra-UT Transaction | CGST+UTGST |

| Inter-State or Inter-UT Transaction | IGST |

Indirect Taxes Subsumed under GST

Central Taxes Subsumed under GST

The Goods and Services Tax replaced the following taxes levied and collected by the Centre:

- Service Tax

- Central Sales Tax

- Central Excise Duty

- Duties of Excise (Medicinal and Toiletries Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Central Surcharges and Cess, so far as they relate to the supply of goods and services.

State Taxes Subsumed under GST

State taxes subsumed under the Goods and Services Tax are:

- State VAT/Sales Tax

- Purchase Tax

- Entertainment and Amusement Tax (other than those levied by the local bodies)

- Luxury Tax

- Octroi Duty and all other forms of Entry Tax

- Taxes on lotteries, betting and gambling

- Mandi Tax

- Taxes on advertisements

- State Surcharges and Cess, so far as they relate to the supply of goods and services.

Taxes Exempted from GST

Though Goods and Services Tax subsumed most of the indirect taxes in India, some indirect taxes are kept out of and exempted from Goods and Services Tax. The most prominent of such taxes are:

- Basic Customs Duty charged on goods imported in India.

- Surcharge on Customs Duty.

- Customs Cess.

- Motor Vehicle Tax.

- Stamp Duty.

- Excise Duty on Liquor (which is levied by State Governments)

- Excise Duty on Petroleum Products (which is levied by Central Government)

- VAT on Petroleum Products

- VAT on Tobacco Products

- Anti-Dumping Duty and Safeguard Duty

- Toll Tax and Entertainment Tax levied by Local Bodies

Goods and Services Tax Council (GST Council)

The 101st Constitutional Amendment Act added Article 279A, which empowers the President to constitute the GST Council for administering & governing the Goods and Services Tax Framework.

It is this council which makes recommendations on everything related to Goods and Services Tax, including laws, rules, rates, etc.

The Composition, Working and Functions of the GST Council can be studied in detail in our article GST Council.

Benefits of Goods and Services Tax

Overall Benefits of Goods and Services Tax

- Creation of a Common National Market: By amalgamating a large number of Central and State taxes into a single tax, it has contributed toward the creation of a common national market.

- Mitigation of Cascading Effect: It mitigated the ill effects of cascading or double taxation. This has benefited the businesses and the overall economy.

- Making Indian Products More Competitive: Reduced level of indirect taxes is making Indian products more competitive in the domestic and international markets.

Benefits of GST for Business and Industry

- Easy Compliance: It is backed by a robust and comprehensive IT system, which makes it easier to comply.

- Uniformity of Tax Rates and Structures: It ensured common indirect tax rates and structures across the country. This has led to increased certainty and ease of doing business.

- Improved Competitiveness: Reduction in transaction costs of doing business eventually leads to improved competitiveness for the trade and industry.

Benefits of GST for Central and State Governments

- Simple and Easy to Administer: Multiple indirect taxes at the Central and State levels have been replaced by Goods and Services Tax. Backed with a robust end-to-end IT system, it is simpler and easier to administer than all other indirect taxes of the Centre and State levied so far.

- Better Controls on Leakage: Easy compliance and easy administration have resulted in better controls on leakages.

- Higher Revenue Efficiency: It decreases the cost of collection of tax revenues of the Government, therefore, leading to higher revenue efficiency.

Benefits of GST for Consumer

- Reduction in Tax Burden: By mitigating the cascading effect as well as rationalizing the tax rates, it has led to reduced tax burdens on goods for end consumers.

- Relief in Overall Tax Burden: Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities has come down, which benefits consumers.

Benefits of GST for States

- Expansion of the Tax Base: As states will be able to tax the entire supply chain from manufacturing to retail.

- Economic Empowerment: Power to tax services, which was hitherto with the Central Government only, will boost revenue and give States access to the fastest-growing sector of the economy.

- Enhancing Investments: Goods and Services Tax, being a destination-based consumption tax, will favour consuming States. Improve the overall investment climate in the country which will naturally benefit the development in the States.

- Increase Compliance: Largely uniform SGST and IGST rates will reduce the incentive for evasion by eliminating rate arbitrage between neighbouring States and that between intra and inter-state sales.

Challenges of GST

- Goods and Services Tax, being a destination-based tax, manufacturing states lose revenue on a bigger scale.

- It has led to a higher tax rate on some goods in order to match the level of revenue collected from earlier multiple taxes. Thus, the Revenue Neutral Rate is higher.

- The reduction in the fiscal autonomy of the States.

- Concerns raised by banks and insurance companies over the need for multiple registrations under GST.

- SCGT and CGST input credit cannot be cross-utilized.

Issue of GST Compensation to States

- GST, being a consumption-based tax, led to a fear that the manufacturing states would lose out a big chunk of their tax revenue. As a result, several states strongly opposed the idea of GST.

- The idea of compensation was mooted to assuage these states. Under this idea, the Centre promised to compensate for the potential revenue loss for states due to the implementation of the Goods and Services Tax (GST).

- To make this promise watertight, the idea of compensation was both written into the Constitution and its finer details passed by way of Central Legislation – the GST (Compensation to States) Act, 2017.

- The GST (Compensation to States) Act, 2017 guarantees the state compensation for loss of revenue on account of the implementation of GST for a transition period of five years between 2017 and 22.

- The compensation is calculated based on the difference between the states’ current GST revenue and the projected revenue after estimating an annualised 14% growth rate from the base year of 2015-16.

Conclusion

Goods and Services Tax (GST) has undoubtedly marked a watershed moment in India’s economic landscape. By streamlining the indirect tax system, it has paved the way for a more efficient and transparent tax regime. Despite initial challenges and ongoing adjustments, GST holds the promise of fostering economic growth, improving tax compliance, and creating a more robust revenue system for the government. As the Indian economy continues to grow, the GST framework should be fine-tuned to address challenges and reap maximum benefits.

Input Tax Credit

- In the context of GST, Input Tax Credit (ITC) refers to the tax already paid by a person or business and which is available as a deduction from the final tax to be payable.

- In simple words, GST paid by a manufacturer on buying raw materials or services as inputs used in the production process can be adjusted against the final payment of GST by him at the time of sale of his/her final product.

- For example, suppose a shoe manufacturer procures leather as raw material for ₹100 + 5% GST (= ₹5). This ₹5 is his input tax credit. Later, when he sells his final product i.e. shoe for say ₹300 + 12% GST (=₹36), this ₹5 will be adjusted against the final GST.

- Thus, the final value of GST paid to him will be = ₹36-₹5 = ₹31.

- Input Tax Credit (ITC) removes the cascading effect of tax and hence helps lower the price of the final product.

- Input Tax Credit (ITC) can be enjoyed at all levels, such as raw material suppliers, manufacturers, distributors or retailers.

- The cross-utilization of the Input Tax Credit (ITC) of CGST is allowed between goods and services. Similarly, the cross-utilization of the Input Tax Credit (ITC) of SGST is allowed between goods and services.

- However, it is to be noted that cross-utilization of CGST and SGST is not allowed, except in the case of inter-state supply of goods and services.

- Input Tax Credit (ITC) on goods and services is not allowed for personal use.

Goods and Services Tax Network (GSTN)

- Goods and Services Tax Network (GSTN) is a Special Purpose Vehicle (SPV) and a fully Government-owned entity.

- The Central Government and the states have equal shares in GST Network (GSTN).

- It functions as the technology backbone for GST in India.

- It is entrusted with the responsibility of maintaining the GST Portal as a single-use interface for the registered taxpayers, which deals with taxpayer registration, return, refund, etc as well as the IT infrastructure required for GST.

Electronic Way Bill or E-Way Bill

- Introduced under the GST regime, an Electronic Way Bill or E-Way Bill is a document required to be carried by the person carrying consignments of goods of value exceeding ₹50,000 for sale beyond 10 km.

- A single system of E-Way Bill is valid throughout the country.

- Under the GST regime, an E-Way Bill is mandatory for movement of goods either within the state or outside the state.

- An E-Way Bill, once created, is valid for 1 day for up to 200 km of travel.

GST Appellate Tribunal

- Goods and Services Tax Act, 2017 mandates the constitution of a GST Appellate Tribunal (GSTAT) and its benches.

- All disputes related to GST Laws at the appellate level are resolved by the GST Appellate Tribunal (GSTAT).

- The principal bench of the GSTAT is to be located in New Delhi. Apart from the principal bench, each state can create a number of benches or boards, subject to the approval of the GST Council.

National Anti-Profiteering Authority (NAA)

- The National Anti-Profiteering Authority (NAA) is a statutory body set up in India under the Central Goods and Services Tax (CGST) Act, 2017.

- Its primary function is to ensure that the benefits of reduced tax rates or Input Tax Credit (ITC) under GST are passed on to consumers by way of lower prices.

Harmonized System Nomenclature Code or HSN Code

- Harmonized System Nomenclature Code or HSN Code is an internationally adopted system for commodity description and product nomenclature.

- It has been developed and is updated every 5 years by the World Customs Organization (WCO).

- Under the GST regime, goods are classified under the HSN Code.

Service Accounting Code or SAC Code

- Similar to the HSN Code, the Service Accounting Code or SAC Code is an internationally adopted system for service description and nomenclature.

- It has been developed and is updated every 5 years by the World Customs Organization (WCO).

- Under the GST regime, services are classified under the HSN Code.

Revenue Neutral Rate (RNR)

In the context of GST, the Revenue Neutral Rate (RNR) refers to the tax rate that would generate the same amount of tax revenue as the previous tax system.

Inverted Duty Structure in GST Regime

- In the context of Goods and Services Tax, an Inverted Duty Structure arises when the tax rate on inputs goods, and services used in the production of another good or service is higher than the tax rate on the final product.

- For example, suppose fabric bags are being produced using non-woven fabric as raw materials. If non-woven fabrics are taxed at 12% and fabric bags are taxed at 5%, the Input Tax Credit (ITC) always gets accumulated at the fabric bags manufacturer’s end.

- The Input Tax Credits (ITCs) so accumulated are finally refunded at the end of a fiscal year. However, it amounts to blocking capital for a certain period.