Cooperative Banks in India hold a unique place in the country’s financial landscape due to their conception and working. Offering a community-focused approach to banking, they are crucial for facilitating financial inclusion, particularly in rural and agricultural sectors. This article of NEXT IAS aims to study Cooperative Banks in detail, including their meaning, types, structure, significance, and more.

What are Cooperative Banks?

Cooperative Banks refer to those financial institutions under the Banking System in India that operate on the principles of cooperation and mutual benefit for their members.

Features of Cooperative Banks in India

- They belong to their members who are both the owners and customers of the bank.

- Thus, it can be said that the customers are the owners of these banks.

- Cooperative Banks are named so because these have the cooperation of stakeholders as the motive.

- They operate on the principle of “one person, one vote” in decision making in decision-making and are managed on the basis of cooperation, self-help, and no profit no loss.

- Along with lending, these banks also accept deposits.

| – They are incorporated and registered under the States’ Cooperative Societies Act passed by the concerned state. – The National Bank for Agriculture and Rural Development (NABARD) is the apex body of the cooperative sector in India. |

Regulation of Cooperative Banks in India

These banks in India, broadly, come under the dual control of:

- Reserve Bank of India: Under the Banking Regulation Act, 1949, and the Banking Laws (Application to Co-operative Societies) Act, 1965, the RBI is responsible for regulating banking aspects of these banks, such as capital adequacy, risk control, and lending norms.

- Registrar of Co-operative Societies (RCS) of respective State or Central Government: They are responsible for regulation of management-related aspects of these banks, such as incorporation, registration, management, audit, supersession of board of directors, and liquidation.

Difference between Commercial Banks and Cooperative Banks

| Basis of Difference | Commercial Banks | Cooperatives Banks |

|---|---|---|

| Formed as | Joint-stock Banks. | Co-operative organizations. |

| Governing Act | Banking Regulation Act 1949. | Co-operative Societies Act of 1904. |

| Regulation | Subject to the control of the Reserve Bank of India directly. | Subject to the rules laid down by the Registrar of Co-operative Societies. |

| SLR and CRR Requirements | Relatively Higher. | Relatively Lower. |

| Services Offered | Larger scope in offering a variety of banking services. | Lesser scope in offering a variety of banking services. |

| Area of Operation | Large-scale operation, usually countrywide. | Small-scale operation, usually limited to a region. |

| Main functions | Mostly provide short-term finance to industry, trade, and commerce, including priority sectors like exports, etc. | Usually cater to the credit needs of agriculturists. |

| Rate of interest | Offer lower rates of interest on deposits compared to co-op banks. | Offer a slightly higher rate of interest on deposits. |

| Borrowers | Borrowers of commercial banks are only account holders and have no voting power as such, so they cannot have any influence on the lending policy of these banks. | Borrowers are member shareholders, so they have some influence on the lending policy of the banks, on account of their voting power. |

| Flexibility in lending | Commercial banks are free from any rigidities in terms of lending options. | Co-operative banks do have not much scope for flexibility on account of the rigidities of the bylaws of the Co-operative Societies. |

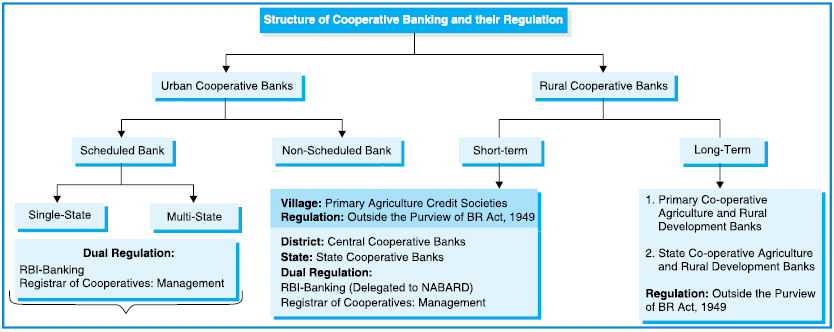

Structure of Cooperative Banks in India

These banks, under the Banking System in India, are primarily categorized into – Rural Cooperative Banks (RCBS), and Urban Cooperative Banks (UCBS). They are further sub-categorised as shown below:

Urban Cooperative Banks (UCBs)

- They operate in urban and semi-urban areas.

- They mainly lend to small borrowers and businesses.

- Based on their regulation regime, they are categorized into two types – Scheduled Banks and Non-Scheduled Banks.

Rural Cooperative Banks (RCBs)

- They focus on serving the financial needs of people in rural areas.

- Depending on the type of lending, they are divided into 2 sub-categories – Short-Term Structures, and Long-Term Structures.

Short-Term Structures

- They lend upto 1 year for purposes such as cultivation activities, buying seeds and fertilizers, etc.

- They have a 3-tier setup.

State Cooperative Banks

- Each state has its own State Cooperative Bank, which is the apex body for cooperative banks in that particular state.

- They operate at the state level.

- It acts as the mediator between RBI and NABARD on the one side and Central or District Cooperative Bank and Primary Agricultural Credit Societies on the other side.

District Cooperative Central Banks (DCCBs)

- They operate at the District level.

- They get loans from the State Cooperative Bank and grant loans to Primary Agricultural Credit Societies and individuals.

Primary Agricultural Credit Societies (PACS)

- Primary Agricultural Credit Society (PACS) is a basic unit and smallest cooperative credit institution in India.

- They operate at the Gram Panchayat and village level.

- They provide short-term loans (1 year to 3 years) to its members for agricultural purposes.

Long-Term Structures

- They lend to meet medium and long-term fund requirements (1.5 years – 25 years) for purposes such as land development, purchase of pumps, etc.

- They have a 2-tier set up:

State Cooperative Agricultural and Rural Development Banks (SCARDBs)

State Cooperative Agriculture and Rural Development Banks (SCARDBs) focus on providing long-term credit for agricultural and rural development purposes.

Primary Cooperative Agricultural and Rural Development Banks (PCARDBs)

Primary Cooperative Agricultural and Rural Development Banks (PCARDBs) are aimed at providing financial services to rural areas, especially to small and marginal farmers, agricultural laborers, and rural artisans.

Significance of Cooperative Banks in India

Due to their very nature of working, they play crucial roles in the Indian economy. Some of their major roles can be seen as follows:

- Financial Inclusion: By reaching out to the unbanked and underbanked sections of society, they play a crucial role in promoting financial inclusion.

- Easy Access to Credit: They offer easy access to credit to their customers that too at competitive interest rates.

- Promoting Savings: They encourage saving habits by offering deposit accounts tailored to rural needs.

- Local Development: These banks understand local needs better and thus play a significant role in rural development by funding various agricultural and rural development activities.

- Rural Development: The majority of these banks operate in rural areas, catering to the specific needs of farmers, small businesses, and low-income households.

- Financial Literacy Promotion: They often act as financial literacy educators, empowering rural communities to make informed financial decisions.

By enabling easy access to institutional credit to under-banked sections, Cooperative Banks in India are pivotal in the socio-economic development of the country. Their role remains crucial in the promotion of small industries, self-employment, and businesses that may not meet the stringent requirements of larger banks. With the changing economic and technological landscapes of the country, these banks have the potential to empower more rural and urban communities, driving forward India’s agenda of inclusive growth and economic development.

Banking Regulation (Amendment) Act, 2020

In light of the crises related to some UCBs, the Banking Regulation Act, 1949 was amended through the Banking Regulation (Amendment) Act, 2020. It is aimed to bring all the UCBs and Multi-State Cooperative Banks under the direct supervision of the Reserve Bank of India (RBI).

Major Features of the Act

- Earlier, the Co-operative Banks were exempted from several provisions of the Banking Regulation Act, 1949. The 2020 Amendment Act applies some of these provisions to them, making their regulation under the Act similar to that of commercial banks.

- It seeks to expand RBI regulatory control over cooperative banks with respect to management, capital, audit, and winding up.

- The RBI may prescribe conditions and qualifications for the employment of the Chairman of these banks. (Previously, it was allowed only for multi-state cooperative banks.)

- RBI may remove a Chairman who does not meet ‘fit and proper’ criteria and appoint a suitable person.

- It may issue directions to reconstitute the Board of Directors in order to ensure a sufficient number of qualified members.

- The RBI may supersede the Board of Directors of a cooperative bank after consultation with the State Government.

- It allows the RBI to undertake mergers and restructuring of a bank in the public interest, without having to order a moratorium, which not only limits withdrawals by depositors but also disrupts the bank’s lending operations.

- Previously, RBI had to first place a bank under a moratorium before preparing a revival scheme for stressed banks, and during the moratorium, no legal action could be initiated.

- The audit of these banks would be conducted on par with scheduled commercial banks.

- Certain provisions relating to winding up and special provisions for speedy disposal of winding up proceedings of banks will now be applicable to these banks.

- The amendment act does not affect the existing powers of the State Registrars of Co-operative Societies under state cooperative laws.

- The amendments do not apply to Primary Agricultural Credit Societies (PACS) or co-operative societies whose primary object and principal business is long-term finance for agricultural development.